& ILLEGAL TAXES…

This blog is a commentary on the process of importing a vehicle, rather than an “How to do…”. You can skip to the end of this blog (don’t, you might miss a laugh!) for some factual information and links, but for a more congealed description of the process, read on. Why ‘congealed’ you might ask? The word comes from the Old French word congeler, ‘to freeze’. Commonly used with ‘blood’ and ‘fat’ becoming thick or solid, it’s quite apt. The import process involved lots of blood, sweat and tears and I’d swear causes hardening of the arteries. Or is it me that is becoming thick and solid?

We did it! We got it done! Actually, ‘Her Outdoors’ did it with no credit to Boris! Imported our motorbike, I hasten to add, not Brexit. It took six visits to the Alfandega (Customs & Excise) and six visits to the IMT(Driver & Vehicle Licensing) in Faro. Not to mention hours of research, early starts, last minute panics, question formulating and translating, numerous photocopies and a huge amount of patience. Oh, and we had to pay a tax that the The European Union (EU) Court of Justice said violated the rules on the free movement of goods. More on that later.

One of the main reasons for importing a vehicle is the inflated cost of used cars in Portugal. When you consider that the minimum monthly salary in Portugal is €700pcm (UK minimum = €1598) and the average salary €1,148 pcm, (UK equivalent = €2791), the costs are ridiculous! You can see opposite a random selection of comparative prices from UK, Germany and Portugal.

There are different views on the reason for the big difference. Some people suggest that because of low income, people hang onto the car longer, so supply is low, demand is high and therefore prices go up. Others argue that the governments ruling on vehicle valuation when importing cars from other EU countries is largely responsible.

Internet research revealed some surprising inconsistencies about importing a vehicle into Portugal. Apparently some people found it rather easy and simple and some find it extremely hard and frustrating. Wow, don’t you just love Google searches. It’s like using predictive text on steroids! I’m guessing that those who found it simple and easy have some or all of the following characteristics;

- Lots of experience importing vehicles into Portugal.

- Good level of Portuguese.

- Huge amount of patience.

- Nothing better to do with their time.

- Served by professional, courteous and helpful staff.

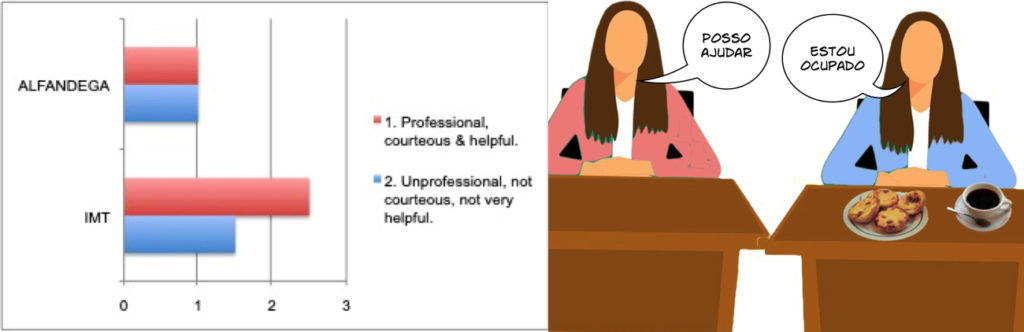

I think point 5 is the key to a positive outcome for non import agents. In both the IMT and Alfandega, we encountered a range of staff; lovely & helpful, not so helpful, dismissive & surly. Maybe that’s why they like you to visit several times, so that statistically, you have a better chance of good service? Statistically, we saw 2 people in the 6 visits to the Alfandega, 50% of whom met criteria 5. At the IMT, 4 staff were sampled, metaphorically speaking. Coincidentally, 50% also met criteria 5. The most significant statistic however, is that 0% (zero, zilch, zip, nil, nought, nada) informed us that it would involve toing and froing between the two institutions. The results can best be seen in the gratuitous graphic below, which serves to break up the tedious writing.

Clearly the main learning point would be to choose the pink person at the Alfandega! Unfortunately she doesn’t dress the same every day. Other colours are available, but are best avoided. You might find it odd how 2 x 0.5 staff got into the survey. The reason is that some of them were helpful, but only up to a point!

Of course, we have to remember when criticising ‘funcionários públicos’ (Portuguese civil servants) that they are not so well paid and have to deal with a belligerent public. Clearly, there is some animosity from expats that have had to pay an ‘illegal car tax’, endure long queues and less than helpful staff. The situation is exacerbated by apparent understaffing and a lack of a ‘customer care’ attitude. ‘Her Outdoors’ valiantly soldiered through each visit using as much Portuguese as possible. Funnily enough, it was only when we wanted to pay that a translator appeared! We spoke to a Portuguese Agent who suggested that the IMT/Alfandega staff are very keen to direct people towards ‘Import Agents’, rather than take the time to explain the system. I presume that this is to make their workloads manageable.

Import Agents are an obvious alternative to trying to do it yourself. But they come at a price, upwards of €500 and you then have the ISV (‘illegal’ registration tax). Given that the value of our motorbike was in the region of €1200, paying such a fee to an agent was a no brainer, if we could do it ourselves. Unfortunately, the ISV would have still set us back €515. We ummed and ahhed whether it was worth it, but because we’d gone so far, we went ahead. We could have avoided this if we had decided much earlier to matriculate a vehicle within six months of being resident. Hindsight is such a wonderful thing. Or is it foresight? Maybe we were just blindsided!

Eventually, after all the visits etc, we were told “ok, that’s it”. We were dazed, incredulous that it was done. Imagine the scene as we sat there, unbelievingly.

- Us – “What do we do now?”

- Them – “Nothing, that’s it”.

- Us – “Really?

- Them – “Yes”.

- Us – “Are you sure”.

- Them – “Yes”.

- Us … standing, ready to go, blinking at each other before slowly walking out the door, expecting an “oh, just a minute”. In Portuguese, of course.…

Well Boris, we got it done. How are you doing? Need any help from ‘Her Outdoors’?

If you want a simple list of the steps:

- Decide whether to matriculate vehicle as soon as you get residency.

- Get an ‘Import a car to Portugal’ folder – lots of paperwork!.

- Register for Online Access to ‘Portal das Finanças’ (You will need a Fiscal number).

- Obtain a Certificate of Conformity (COC) for your vehicle (ideally before you move to Portugal).

- Fill in an IMT model 9 form.

- Fill out the DAV (Declaração Aduaneira de Veículos – Customs declaration of vehicles).

- Pay the DUC (Documento Único de Cobrança – is like a bill that you get from the Customs, stating what you have to pay for getting the DAV).

- Car inspection – done once per year (unless it’s a new car), and it’s mandatory to ensure your vehicle has the proper conditions to circulate safety.

- Taxes to Import a car to Portugal.

- After your car gets approved in the inspection, it’s time to pay the taxes (unless you are exempt).

- Get your Portuguese car document, the ‘Documento Único Automóvel’.

- Register your car

- Obtain Licence plates

- Pay one more tax, the IUC

- Looking for a more detailed explanation of the vehicle registration process?

- An excellent link for information on the different vehicle taxes can be found here.

- To register with the Portal das Finanças (in Portuguese).